Search Results for "bank for international settlements"

Bank for International Settlements Reveals Findings on Central Bank Digital Currencies

The Bank for International Settlements released its analysis report in which it evaluated central bank digital currencies globally.

Bank for International Settlements to Issue a PoC CBDC With the Swiss Central Bank Before the End of 2020

The Bank for International Settlements is set to issue a CBDC at the Proof of Concept stage in conjunction with the Swiss National Bank before year-end.

How Does Cryptocurrency Regulation News Affect the Bitcoin Price? Bank Of International Settlements Research Reveals

New research conducted on behalf of the Bank for International Settlements indicates that contrary to popular belief, the Bitcoin price and other cryptocurrency prices respond very positively to news of coming regulations,when they are clear.

Bank of International Settlement Revealed Positive Outlook on Central Bank Digital Currencies

The Bank for International Settlements (BIS), a coalition of 62 central banks, has weighed in on the trending topic of central bank digital currencies (CBDCs). The global central bank noted a positive interest by central banks to develop their state-backed digital currencies.

G20 Announces Standards for Global Crypto Regulation

G20 countries have announced that the Financial Stability Board, the International Monetary Fund, and the Bank for International Settlements will release recommendations on global crypto regulation by July.

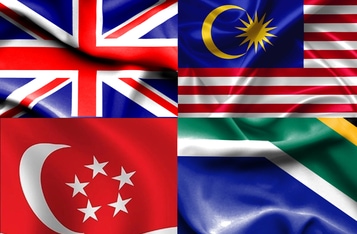

Four Countries to Conduct Cross Border CBDC Payment Trials

The Bank for International Settlements (BIS) has joined forces with the central banks of South Africa, Malaysia, Singapore, and Australia to kick start a project dubbed Dunbar aimed at testing the use CBDCs in cross border payments.

The Bank for International Settlements Gives CBDCs Full Backing

The Bank for International Settlements (BIS) announced its full support for developing central bank digital currencies (CBDCs) in pursuing financial and monetary stability through international cooperation with the mandate and support by central banks.

New BIS Report Advocates Using Embedded Monitoring Trackers For Stablecoins

A new report from the Bank for International Settlements has advocated the deployment of ‘Embedded Systems’ in the monitoring of global stablecoin projects.

"Bitcoin Is Risky," Says BIS Chief as Crypto and Unconventional Stocks like GameStop Gain Support

The Bank for International Settlements remains skeptical of Bitcoin, echoing the sentiments of many traditional banking institutions.

World Bank Pushes to Raise the Bar for FinTech and DLT for Cross-Border Interoperability and Financial Inclusion

The World Bank Group has recently published a study, issued by the Bank for International Settlements (BIS) on “Payment aspects of financial inclusion in the FinTech era,” highlighting the concepts derived using blockchain, including stablecoins, and central bank digital currencies (CBDCs).

BIS Economist Proposes "Embedded Supervision" to Enhance Transparency of Tokenized Markets

Economist Raphael Auer of the Bank for International Settlements (BIS) has championed distributed ledger technology (DLT) as a way of supervising financial market risks.

Ripple’s Partner Santander Bank Won’t Use XRP for International Payments Due to Low Adoption

Santander Bank, a major European financial presence and one Ripple’s most prestigious partners is reportedly hesitating to add XRP to its international payments network - One Pay FX